ChatGPT Stock Price Prediction: Revolutionizing Investment Strategies with AI

1. Introduction

- 1. Introduction

- 2. The Potential of ChatGPT in Predicting Stock Market Movements

- 3. How ChatGPT Predicts Stock Price Movements

- 4. The Experiment: Analyzing News Headlines with ChatGPT

- 5. Outperforming Traditional Sentiment Analysis Methods

- 6. Implications for the Future of Finance

- 7. Benefits for Institutional Investors

- 8. Regulatory Considerations and the Role of ChatGPT

- 9. Advancements in Language Understanding Capabilities

- 10. Practical Applications and Integration of ChatGPT in Investment Strategies

- 11. A Broader Academic Discourse on AI Applications in Finance

- Conclusion

- FAQs

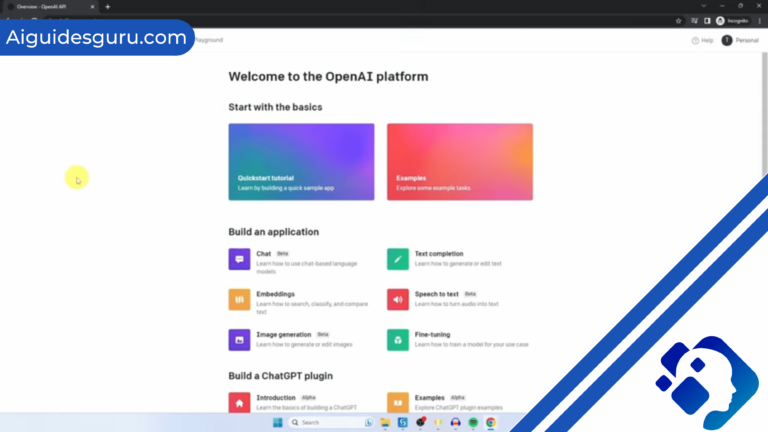

Artificial Intelligence (AI) has revolutionized various industries, and now it’s making its mark in the world of finance. ChatGPT, a popular AI chatbot developed by Open AI, is showcasing its potential in predicting stock market movements. In a recent study conducted by finance professors from the University of Florida, ChatGPT demonstrated surprising accuracy in analyzing news headlines and determining their impact on stock prices. This groundbreaking research has sparked interest among investors and experts, highlighting the transformative power of AI in the financial sector.

2. The Potential of ChatGPT in Predicting Stock Market Movements

ChatGPT, powered by large language models (LLMs), has gained immense popularity due to its ability to generate human-like text and perform various language tasks. However, the question of whether it can predict stock price movements has remained a subject of debate. The study conducted by Alejandro Lopez-Lira and Yuehua Tang aimed to address this question by harnessing the capabilities of ChatGPT and analyzing its predictive power in the stock market.

3. How ChatGPT Predicts Stock Price Movements

To understand how ChatGPT predicts stock price movements, the researchers fed it over 50,000 news headlines about companies listed on major stock exchanges. By using sentiment analysis, ChatGPT assigned a “ChatGPT score” to each headline, indicating whether it was good, bad, or irrelevant for the company’s stock prices. These scores were then analyzed to determine their correlation with the companies’ stock market performance the following day.

4. The Experiment: Analyzing News Headlines with ChatGPT

In the experiment, the researchers provided ChatGPT with a prompt instructing it to evaluate the sentiment of each headline. They asked the chatbot to categorize the news as good, bad, or uncertain and provide a concise sentence elaborating on its assessment. This approach allowed ChatGPT to process textual information and generate sentiment scores for each headline.

5. Outperforming Traditional Sentiment Analysis Methods

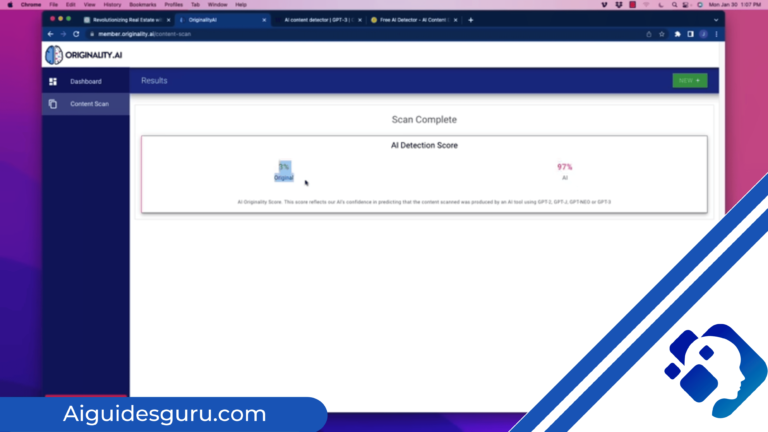

The study’s findings revealed a significant positive correlation between the ChatGPT scores and the next-day stock performance of the analyzed companies. Notably, ChatGPT outperformed traditional sentiment analysis methods that relied on data from headlines and social media to predict stock movements. This suggests that incorporating advanced language models like ChatGPT into investment decision-making processes can lead to more accurate predictions and enhance the performance of quantitative trading strategies.

6. Implications for the Future of Finance

The research conducted by Lopez-Lira and Tang holds promising implications for the future of finance. By integrating AI language models like ChatGPT into investment frameworks, investors can potentially trade faster and adapt to market changes more swiftly. This increased efficiency could lead to stock prices reflecting the most up-to-date information, making it harder for investors to outperform the market.

7. Benefits for Institutional Investors

While the implementation of ChatGPT’s predictive capabilities may be limited to institutional investors with the necessary infrastructure, its impact can still benefit everyday investors indirectly. A more efficient market, driven by accurate predictions and fair pricing, can level the playing field for retail investors and reduce information asymmetry.

8. Regulatory Considerations and the Role of ChatGPT

As the adoption of language models like ChatGPT increases, regulators and policymakers may need to address potential implications. The reliance on AI models for investment decisions raises questions about information accuracy and potential market manipulation. Regulators may need to develop frameworks that ensure transparency, accuracy, and accountability in the use of AI in finance.

9. Advancements in Language Understanding Capabilities

The superiority of ChatGPT in predicting stock market returns can be attributed to its advanced language understanding capabilities. By processing textual information and capturing the nuances and subtleties within news headlines, ChatGPT generates more reliable sentiment scores. This enables the model to provide more accurate predictions of daily stock market returns.

10. Practical Applications and Integration of ChatGPT in Investment Strategies

The research conducted by Lopez-Lira and Tang provides empirical evidence supporting the efficacy of language models like ChatGPT in predicting stock market returns. Asset managers and institutional investors can consider incorporating these models into their investment strategies to improve performance and reduce reliance on labor-intensive analysis methods. However, it’s essential to recognize that the adoption of AI models may need to be tailored to specific investment objectives and risk tolerances.

11. A Broader Academic Discourse on AI Applications in Finance

The study contributes to the academic discourse on AI applications in finance, particularly in the realm of predicting stock market movements. By exploring the capabilities of ChatGPT, researchers gain a deeper understanding of the potential and limitations of language models within the financial economics domain. This knowledge can inform future research and drive further innovation in AI-based financial analysis.

Conclusion

The study conducted by finance professors from the University of Florida demonstrates the potential of ChatGPT in predicting stock market movements. By leveraging advanced language understanding capabilities, ChatGPT outperforms traditional sentiment analysis methods and provides more accurate predictions of daily stock market returns.

While the implementation of AI models in investment decision-making may be limited to institutional investors, the benefits of a more efficient market trickle down to everyday investors. The findings of this research pave the way for further exploration of AI applications in finance, offering insights into the transformative power of AI in the industry.

FAQs

Can ChatGPT completely replace human investment analysts?

While ChatGPT has demonstrated impressive predictive power, it is unlikely to completely replace human investment analysts. Human expertise, intuition, and contextual understanding still play a crucial role in investment decision-making.

What are the potential risks associated with relying on AI for stock market predictions?

The reliance on AI for stock market predictions poses potential risks, including information accuracy, market manipulation, and overreliance on models that may not account for unforeseen events or market dynamics. Regulators and policymakers need to ensure transparency and accountability in the use of AI in finance.

How can retail investors benefit from the integration of ChatGPT in investment strategies?

A more efficient market, driven by accurate predictions and fair pricing, benefits retail investors by reducing information asymmetry and promoting fairer pricing. However, it’s important for retail investors to consider their risk tolerance and investment objectives when incorporating AI models into their strategies.